unfiled tax returns 10 years

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. How Many Years Does the IRS Go Back for Unfiled Tax Returns.

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

This penalty applies the first day you are late and it can get up to 25 of the.

. If you owe tax the IRS will impose a failure-to-file penalty for 5 of the tax owed per month that you are late. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. The IRS can legally pursue you for unpaid taxes 10 years after filing your return and taxes being assessed.

Systemically holds an individual taxpayers income tax refund when their account has at least one unfiled tax return within the five years. In most cases the IRS goes back about three years to audit taxes. My income is modest and I will likely receive a small refund for.

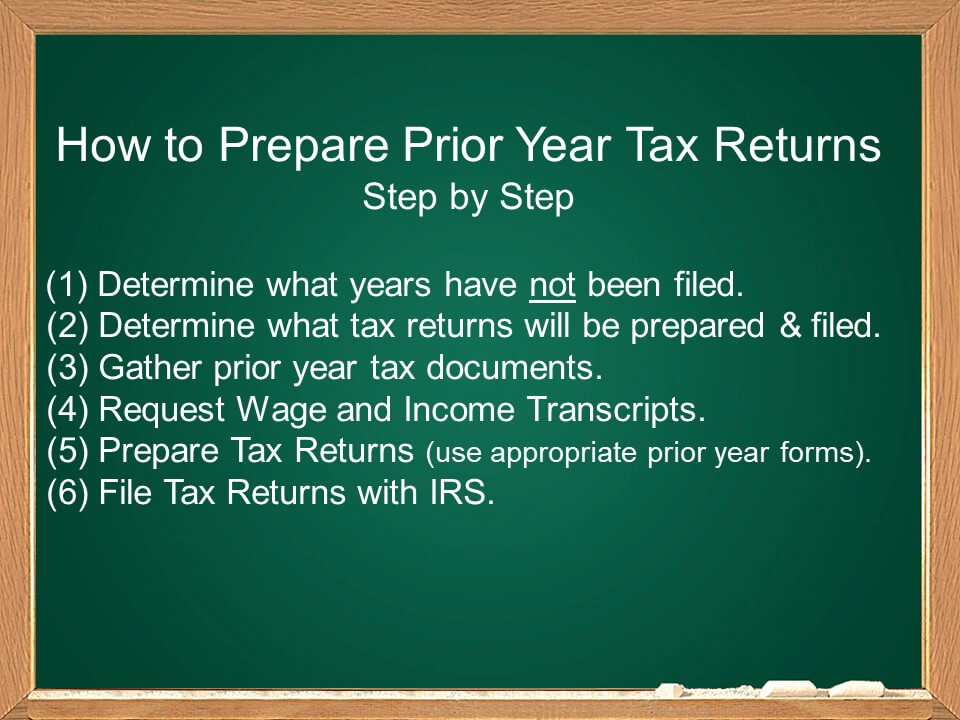

The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. Good news the IRS can provide you with the last 10 years of your Wage and Income Transcripts at no charge to you. Any information statements Forms W-2 1099 that you may.

Contact a tax professional. Youll need tax documents for the year youre filing your tax return for eg youll need your W-2 1099s or other documents from 2018 if youre filing your 2018. If you fail to file your taxes youll be assessed a failure to file penalty.

24000 for married taxpayers filing. A copy of your notices especially the most recent notices on the unfiled tax years. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Tax will be assessed and youll receive a notice demanding payment. State tax returns not filed for more than 20 years. 12000 for single filers or married filing separate returns.

Once the SFR is filed your problems are just beginning. Part of the reason the IRS requires. You will however need to call and request the.

After May 17th you will lose the 2018 refund as the statute of limitations. If youre overwhelmed with your taxes they might be able to support you with any. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

Here are 10 things you should know about getting current with your unfiled returns. The CRA will let you know if you owe any money in penalties. I havent filed taxes in over 10 years.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

IRS and states will usually come up with much higher balances than you. Expect the IRS to then take the following actions. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

Non-employment compensation royalties and other miscellaneous income on 1099-MISC. Delinquent Return Refund Hold program DRRH. Ad Quickly Prepare and File Your Unfiled Taxes.

Bring these six items to your appointment. We Help You Negotiate the Lowest IRS Payment Amount Allowed By Law. For the 2018 tax year these amounts were as follows.

The IRS isnt likely to forget about past due taxes or unfiled tax returns. 18000 for head of household filers. If your return wasnt filed by the due date including extensions of time to file.

If you are missing records to correctly file your back taxes the transcript you want. In most cases the IRS requires the last six years tax returns to be filed as an indicator of. Often they go back many years longer than the IRS.

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Irs Tax Returns Best Tax Relief Company Is

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Unfiled Tax Returns Archives Irs Mind

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

Unfiled Tax Returns Mendoza Company Inc

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Tax Returns Premier Tax Solutions

How Far Back Can I Do My Taxes In Canada Ictsd Org

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Tax Returns 12 Irs And Nys Must Know Faqs

How Far Back Can The Irs Collect Unfiled Taxes

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829